![]()

Introduction:

The Negotiable Instrument Act 1881, Section 13 defines “Negotiable Instrument” means a promissory note, bill of exchange or cheque payable either to order or to bearer. The term ‘negotiable’ means transferable from person to another in return of some consideration and ‘instrument’ means, a signed document entitles a specific person to receive the payment. The difference between Negotiable documents and the other documents is that in the negotiable instrument case, the transferee gets the good title in the good faith and consideration irrespective of the status of the transferor, not in the case of other documents, the transferee gets the same title as that of the transferor.

The legal maxim nemo dat quod non-habet means that no one can transfer then a better title than he. This principle is relating to the transfer of property is that no one becomes the owner of the property unless he purchases it from the true owner of or with his authority. This instrument is the document that expresses the payment obligation and right to possess the instrument as a true owner.

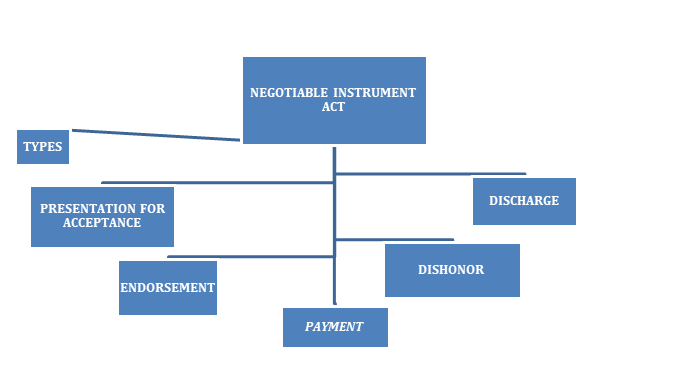

For the better understanding we divide this concept in the following manner:

Types of Negotiable Instruments

This act talks about three types of instruments that are promissory note, bill of exchange and cheque.

Promissory Note

Promissory notes are also called Pro-Notes, and its conditions are mentioned on the Section 4 of NI Act states that “It is the instrument in writing (not being bank notes or the currency notes) containing an unconditional undertaking signed by the maker, to pay a certain sum of money only to, or to the order of, a certain person, or to the bearer of the instrument”.

Requirement of Promissory notes are:

Written, duly signed and stamped

- Unconditional

- Promise to pay money and money only

- Certainty of parties, amount and time

- Unconditional

Bills of Exchange

Bills of Exchange or Bill defined under Section 5 of the NI Act; it is the written order which binds the party to pa the specific amount to another person on demand or at a predetermined date. BOE transactions may involve up to three parties.

- Drawer: The person who obliges the party to pay a certain amount to another

- Drawee: The person who pays the amount specified in the BOE

- Payee: The person who receives the amount

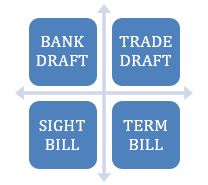

Bank Draft when they are issued by the bank.

Trade Draft when they are issued by individuals.

Sight Bill when they are paid immediately or on-demand.

Term Bill when they are paid at a set date.

EXAMPLE:

A person purchases goods from ABC Company for $6000 and draws the bill on X payable to ABC on his order on 15 September 2020.

- Written, signed and duly stamped

- Unconditional

- Order to pay money and money only

- Certainty of parties, amount and time

- Unconditional

Difference between Promissory Note and Bills of Exchange

| PROMISSORY NOTE | BILLS OF EXCHANGE |

| PROMISE | ORDER |

| 2 PARTIES | 3 PARTIES |

| NO ACCEPTANCE | ACCEPTANCE IS MUST |

| Drawer LIABILITY is primary | Drawer LIABILITY is secondary and conditional |

Cheque

Cheque is defined under Section 6 NI Act, 1881

- There are 3 parties involved in a Cheque: the drawer, the drawee bank and the payee

- It must be in writing and it must be signed by the drawer

- The payee is always certain

- They are always payable on demand

- There must be a date on the Cheque otherwise it would be invalid and not honored by the bank

- The amount must be specified both in figures and words. According to Section 18 of the NI Act if the amount mentioned in word and figure doesn’t match then the amount mentioned in the word form will be considered

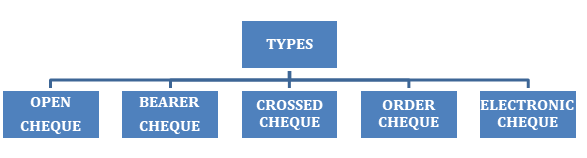

OPEN CHEQUE: Open cheque is the cheque, which can be cashed at the counter.

BEARER CHEQUE: Bearer cheque is similar to the open cheque but in this, any person holding or bearing the cheque can be made payment of the stated amount.

CROSSED CHEQUE: In this danger of open cheque can be avoided which only credit in the bank can account of the payee. This cheque can be made by drawing two parallel lines on the left-hand side top corner of the cheque

ORDER CHEQUE: Cheque which is payable to the particular person only.

ELECTRONIC CHEQUE: Cheque which contains the exact mirror image of the cheque with all the security features.

NOTE:

In Cheque Truncation a scanned electronic image of the cheque is made which substitutes the physical movement of the cheque.

Difference between Bills of Exchange and Cheque

| BILLS OF EXCHANGE | CHEQUE |

| Bills of exchange can be drawn on anybody. | Cheque can be drawn on a banker |

| Bills exchange is payable either on-demand or after the specific period. | Cheque is always payable on demand(Section 19) |

| Bill of exchange can be crossed to end its negotiability | Cheque can’t be crossed |

| Acceptance is a must. | Acceptance is not required. |

Presentation for Acceptance

Once the Negotiable Instrument is draft then they need to present before drawee. Acceptance need to an express, Acceptance of the instrument is the act where drawee accepts the instrument by signing under the words ‘accepted’ on the face of it. It is the drawee signature to honor the instrument as presented. Instrument needs not to be presented in the case promissory note and cheque however it is mandatory in the case of bills of exchange.

Endorsement

Once the instrument is accepted by the drawee, it can be further transferred by the holder of the instrument which is termed as an endorsement. The holder of the negotiable instrument in signing his name on the back of the instrument thereby transferring the title or ownership is an endorsement. An endorsement may be made to another person or any legal entity. The person making the endorsement is called as an endorser and to whom the instrument is endorsed is endorsee.

Essentials of endorsement:

- Details On the back or the front of the instrument

- Drafted by the maker or holder only

- It must be for the complete negotiation instrument

- No specific form of words is required for endorsement

The effects of endorsement:

- The property is transferred from the endorser to the endorsee.

- The endorsee gets right to negotiate it further

- The endorsee gets right to sue in his name to all other parties.

Holder and Holder in Due Course

HOLDER: Section 8 of the NI Act defines the Holder is the person who is entitled in his name to the possession of the negotiable instrument.

HOLDER IN DUE COURSE: Section 9 of the NI Act defines Holder in due course is the person who must have the possession of the instrument or the person who holds the instrument in good faith to hold ii with due care and caution for some consideration till maturity.

The basic difference between Holder and Holder in due course

| Holder in Due Course | Holder |

| Consideration is must | Consideration is not necessary |

| He cannot acquire the instrument after the maturity. | He can acquire the instrument even after maturity. |

| Holder in due course gets the title better than the transferor. | Holder doesn’t get title better than the transferor. |

| More advantageous position, he is free from all equities. | A less advantageous position doesn’t enjoy any special privilege. |

Presentation for Payment

The negotiable instrument, promissory note, or bills of exchange is either payable on-demand or on a specific date or after a specific period as mentioned in the instrument. The instrument in which no time is mentioned is payable on demand. A cheque is always payable on demand. The instrument which needs to payable after the specific period as mentioned on it needs to be presented[section 64 of NI Act] for the payment at maturity on the third day after the day which is expressed to be payable[section 22 of NI Act]

Dishonor

A promissory note, bill, or cheque is dishonored if the maker, drawer, or acceptor of the cheque commits default in acceptance or payment [section 91 and 92 of NI Act]. If at the time of presentation of the promissory note or bill of exchange the accepter excuses the payment and payment remains overdue or refusal to accept the in case of bills of exchange the instrument is said to be dishonored. In case of dishonor of negotiable instrument by non-acceptance or non-payment a liable holder should notify all the parties of his liability by issuing a notice of dishonor within a reasonable period [section 93 of the NI Act].

SECTION 138 of NI Act creates statutory offense in the matter of dishonor of cheque on the ground of insufficiency of funds. But there are many reasons for the dishonor of cheque like signature doesn’t match, payment stopped by the drawer, account closed by the drawer or any other default dishonors the cheque by bank despite legal notice of demand shall be considered as a criminal offense under this section.

Essentials of Section 138 of the NI Act:

- A person should have legally enforceable debt

- The cheque is returned due to insufficient funds

- Cheque is presented within 6 months from the date of its drawn or till its validity whichever is earlier

- A written notice within 30 days

- The payee or holder doesn’t receive the payment within 15 days of sending written notice to the drawer.

Two types of liabilities under 138

CIVIL LIABILITY

- Twice the amount of dishonor of cheque

- If payee files suit under Order 37 of CPC, 1908 and judgment is in favor of payee then the amount as per the court order

CRIMINAL LIABILITY

Drawer is punished for two years and fine under the section 417 and 420 of IPC.

Territorial Jurisdiction Under S. 142(2)

The complaint has to file before the court having local jurisdiction to the bank where the transaction is completed held in K.Bhaskaran v. Sankaran Vaidhyan Balan.

Discharge

The liability of the party on the instrument comes to an end when the instrument is discharged. After discharge, even a holder in due course acquires no right under it and he can’t bring a suit on the face of it.

A negotiable instrument is discharged in any one of the following manners.

- By payment in due course

- By the principal debtor becoming the holder

- By the renunciation of the rights by the holder

- By cancellation of the instrument

- By the default that would discharge an ordinary contract

Conclusion

The main purpose of the negotiable instrument is to avoid the miscarriage of a higher amount of money and to reducing the risk of theft, robbery and to regularize the monetary transactions. To give legal effect to the negotiable instrument, there is legislation and the name of the legislation is the Negotiable Instrument Act, 1881. A minor can be a party to the negotiable instrument with no liability.

0 Comments